Workday (WDAY)·Q4 2026 Earnings Summary

Workday Beats Q4 Estimates but Stock Drops 7% on Slowing Growth Outlook

February 24, 2026 · by Fintool AI Agent

Workday delivered a clean Q4 beat—revenue of $2.53 billion topped consensus by 0.4%, while non-GAAP EPS of $2.47 beat by 6.5% . But the stock plunged 7.6% afterhours to $120.38 as FY2027 guidance disappointed. Subscription revenue growth is decelerating from 14.5% in FY26 to 12-13% in FY27, signaling the high-growth era may be ending .

Co-founder Aneel Bhusri returned as CEO and framed AI as the next transformation opportunity: "We built Workday to bring innovation back to the worlds of HR and finance, and AI gives us the chance to do it all again" .

Did Workday Beat Earnings?

Yes. Workday beat on both lines and extended its streak to 9 consecutive quarterly beats:

*Values retrieved from S&P Global

The margin beat was particularly strong—non-GAAP operating margin of 30.6% came in 210 basis points above the 28.5% guidance from November, even absorbing $130M in restructuring charges .

Beat/Miss History (8 Quarters)

*Values retrieved from S&P Global

What Did Management Guide for FY2027?

This is where the stock sold off. FY2027 guidance implies meaningful growth deceleration:

And Q1 FY2027 guidance:

The 12-13% subscription revenue growth outlook compares poorly to the 14.5% Workday just delivered in FY26 . CFO Zane Rowe said the company is "prioritizing investment in our agentic AI roadmap to capture a larger market opportunity" —suggesting AI investments will pressure near-term growth.

How Did the Stock React?

WDAY got crushed afterhours despite the beat:

The stock had already fallen 35% over the past year heading into earnings. Today's afterhours move suggests the market expected better FY27 guidance or more aggressive cost actions.

What Changed From Last Quarter?

Several meaningful shifts emerged in Q4:

Leadership Change: Aneel Bhusri returned as CEO after Carl Eschenbach stepped down. This marks Bhusri's return to day-to-day operations after serving as executive chair .

Acquisition Spree: Workday closed three acquisitions in Q4:

- Paradox (Q3) - Conversational ATS for frontline hiring

- Sana (Q4) - Enterprise learning platform, now GA

- Pipedream (Q4) - AI agent integration platform with 3,000+ connectors

AI Scale: Workday delivered 1.7 billion AI actions across its platform in FY2026 .

Backlog Strength: 12-month subscription revenue backlog grew 15.8% to $8.833B. Total subscription revenue backlog reached $28.1B, up 12.2% .

Capital Return: Workday repurchased ~12.8 million shares for $2.9 billion during FY26 .

What Are the Full-Year FY2026 Results?

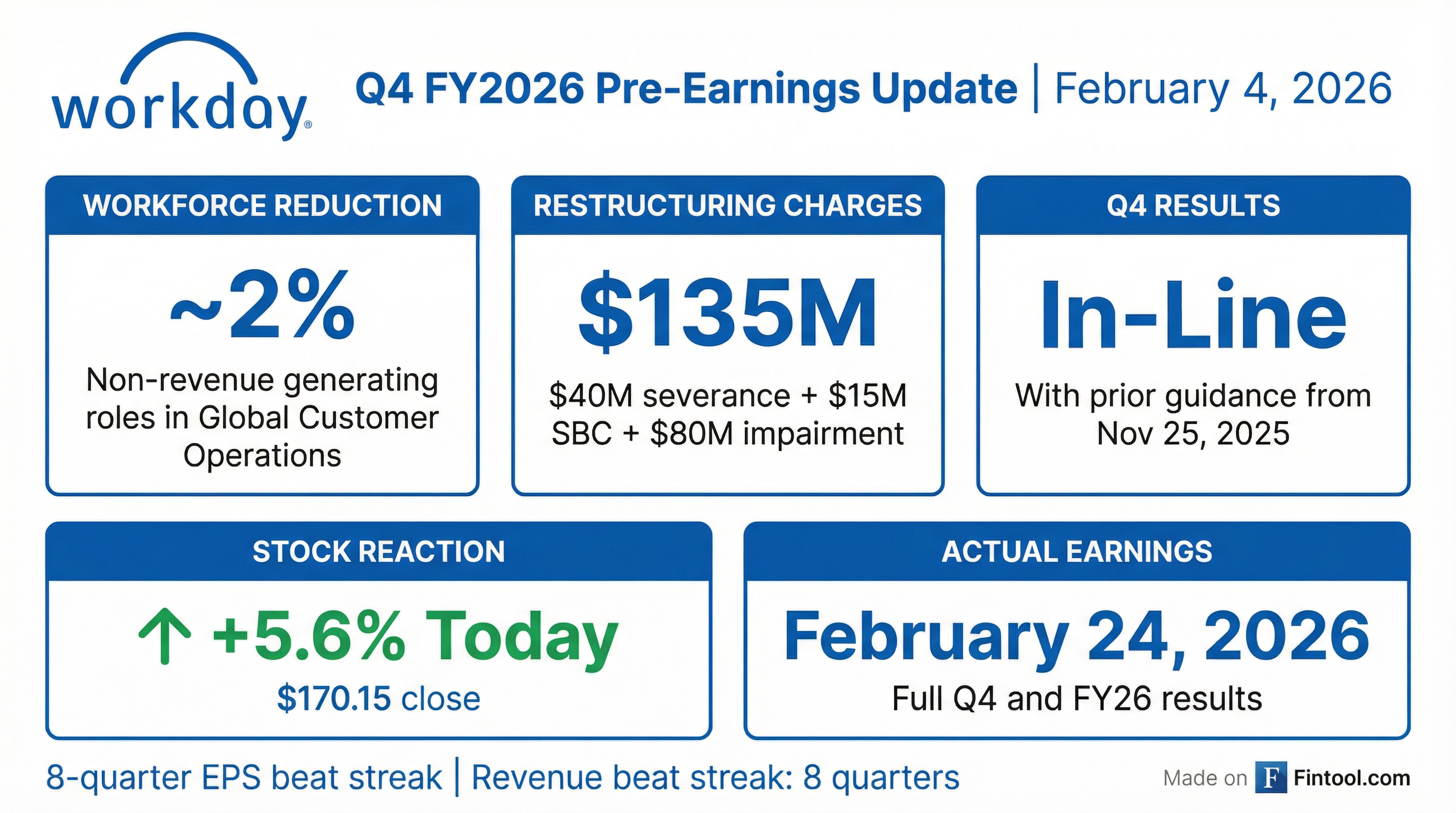

GAAP operating income was impacted by $303M in restructuring costs (vs $84M in FY25), including the workforce reduction announced earlier this month .

Balance Sheet & Cash Position

Cash declined from $8B to $5.4B largely due to $2.9B in share repurchases and ~$2.1B in acquisitions .

Key Business Highlights

- Customer Count: Over 11,500 customers globally, including 7,000+ core Financial Management and HCM customers

- New Customers: Boston Children's Hospital, Copenhagen Airports, Fruit of the Loom, Insomnia Cookies, Lavazza, State of NY Court System

- Expansions: Accenture, Ally Financial, Anthropic, eBay, Iron Mountain, Merck, Otis Elevator

- EU Sovereign Cloud: Launched to help EU organizations maintain local data control

- Workday GO: Expanded for midsize businesses with new global payroll and AI-powered deployment

Forward Catalysts and Risks

Catalysts to Watch:

- Agentic AI product launches (Sana Core/Enterprise now GA)

- Pipedream integration enabling AI agents across 3,000+ apps

- Government sector momentum (DIA contract, World Economic Forum partnership)

- Margin expansion trajectory toward 30%+ non-GAAP operating margin

Risks:

- Growth deceleration accelerating (14.5% → 12-13% subscription growth)

- Enterprise spending environment remains uncertain

- Integration risk from three acquisitions in quick succession

- Stock near 52-week lows despite consecutive beats—sentiment overhang

Consensus Estimates Going Forward

*Values retrieved from S&P Global (pre-earnings consensus, may be revised)

Related: Workday Company Profile | Q3 FY2026 Earnings Transcript